The WazirX Incident: A Wake-Up Call for Cryptocurrency Security

Introduction

In mid-2024, WazirX, one of the leading cryptocurrency exchanges, experienced a severe security breach. The hack led to the loss of approximately $30 million in digital assets. When the breach occurred, the internal alarms triggered an immediate response from the security team.

WazirX’s CEO, Nischal Shetty, highlighted the unprecedented nature of the breach, emphasizing the severity of the situation. “This breach is a serious wake-up call for all of us,” he stated. Users affected by the hack also expressed their distress, amplifying the emotional weight of the incident.

Dissecting the Hack: A Technical Deep Dive

When the WazirX breach unfolded, it exposed more than just the funds of its users—it revealed significant cracks in the crypto security armor.

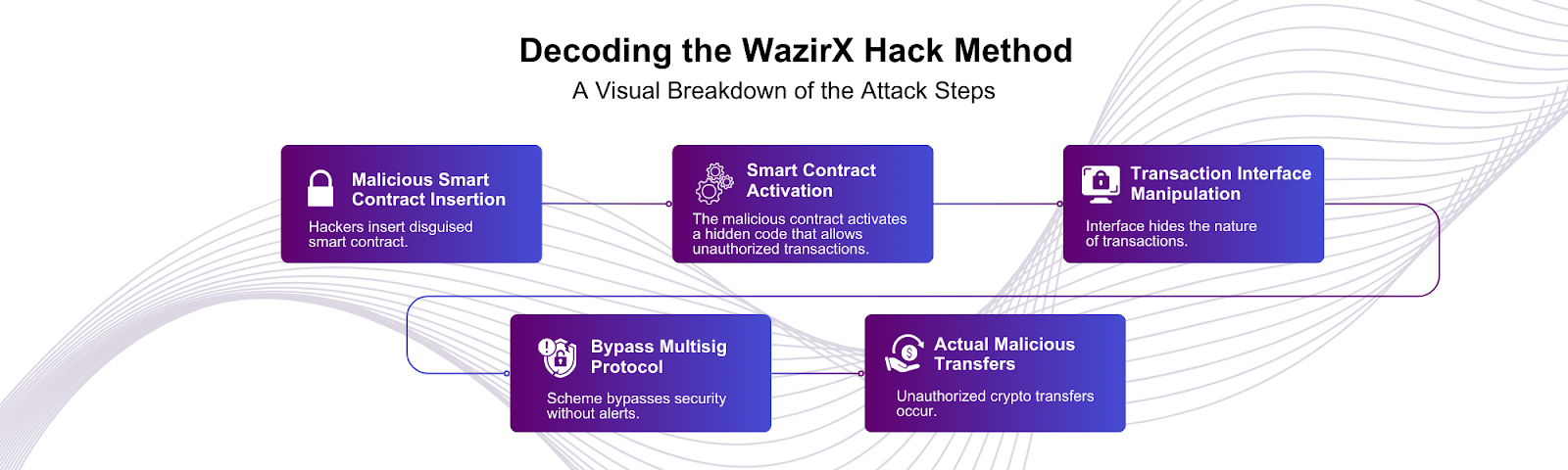

The attackers used a sophisticated scheme involving a Gnosis Safe multisig wallet, which typically requires four out of six signatures to authorize transactions. Here’s how they did it:

- Smart Contract Manipulation: Eight days before the breach, the hackers inserted a malicious smart contract that appeared harmless in the transaction management interface, Liminal, but was anything but.

- Discrepancy Exploitation: While Liminal showed standard transactions, the actual processes were malicious transfers, cleverly bypassing the multisig protocol without triggering alarms.

The hack was detected immediately on July 18, 2024, leading to a comprehensive emergency response:

- Emergency Response:

- WazirX immediately informed stakeholders and law enforcement.

- All transactions were frozen to prevent further losses.

- Tracking the Theft:

- Hackers swiftly moved large sums in cryptocurrencies, including Ethereum and SHIBA.

- WazirX used blockchain analysis to trace the stolen funds and alerted other exchanges to potentially compromised assets.

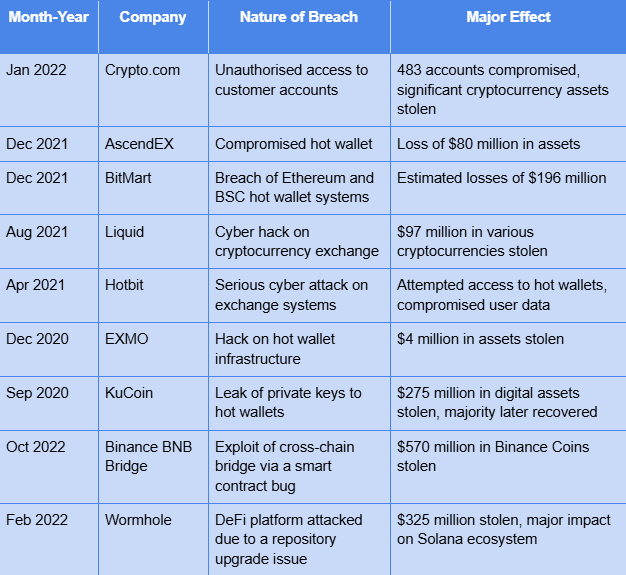

This incident mirrors other significant breaches in the crypto world, such as those at Coincheck and KuCoin, underscoring ongoing security vulnerabilities. In response, WazirX overhauled its security infrastructure, implementing:

- Enhanced Wallet Security:

- Tighter controls over access and more rigorous verification processes for transactions.

These measures are now setting new standards for multisig wallet security within the industry

A precarious Crypto space.

The Aftermath: Immediate Responses and Long-term Implications

Following the breach, WazirX took immediate and strategic steps to manage the crisis and secure their platform:

- Immediate Suspension of Transactions: On July 18, 2024, WazirX swiftly suspended all INR and crypto withdrawals. This decisive action aimed to halt any further unauthorized activities after the breach was detected. WazirX communicated this suspension through an official statement, ensuring users were fully aware of the gravity of the situation and the protective measures being implemented

- Enhanced Communication: The exchange used every available channel—social media, emails, and their website—to inform and reassure users. They explained what happened and detailed the steps being taken to address the breach, maintaining a transparent approach to manage user anxiety effectively.

- Partnerships for Recovery: WazirX collaborated with blockchain analytics experts, such as Cyvers and ZachXBT, to trace the stolen funds. They also worked with other exchanges to blacklist the affected wallet addresses to prevent further misuse.

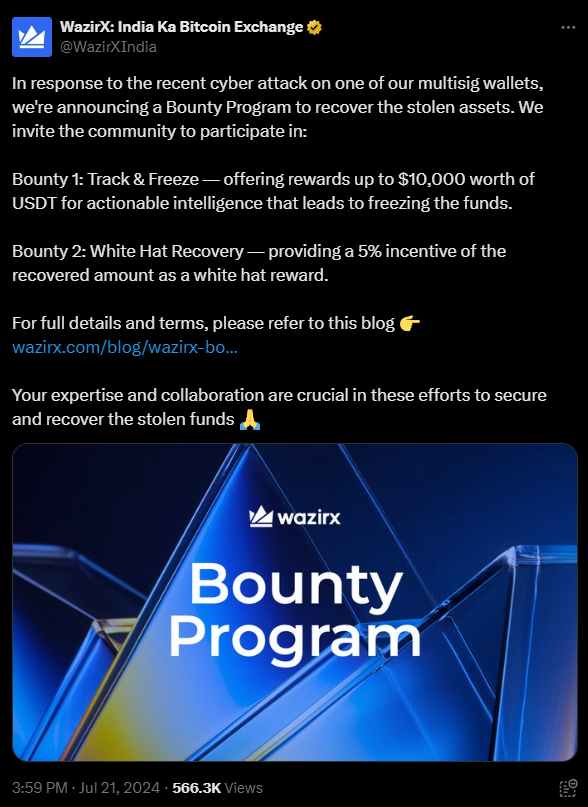

Bounty Program: They launched a bounty program, offering a reward of up to $10,000 in USDT for information that could help recover the stolen assets or lead to the arrest of the culprits.

Source: Twitter

The economic impact was immediate and widespread:

- Market Volatility: The hack led to a sharp decline in WazirX’s trading volume, which dropped by approximately 30% within a week. The value of their native token, WRX, plummeted by 25%, reflecting the loss of investor confidence. This created ripples across the crypto market, leading to a 15% drop in the price of major cryptocurrencies like SHIB and ETH.

- Security Enhancements Across the Industry: The incident prompted a broad reassessment of security protocols within the crypto community. Many investors and platforms initiated comprehensive reviews of their security measures. As a result, the industry saw a 40% increase in the adoption of advanced security features, such as two-factor authentication and cold storage solutions, to prevent similar breaches.

In the long term, the breach has significant implications for regulatory and security standards:

- Regulatory Scrutiny: Particularly in India, the hack has sparked intense discussions about the need for stricter security protocols and operational standards, influencing future legislative frameworks worldwide.

- Industry-Wide Security Reevaluation: It highlighted vulnerabilities even in well-secured platforms, pushing the crypto industry to strengthen security measures further. This could slow down new investments but ensure more robust protections for users' assets.

Rebuilding Trust: Security Innovations and Community Engagement

After the security breach, WazirX took decisive steps to not only mend but also enhance their systems to ensure such incidents are less likely in the future. Their proactive approach in upgrading their security measures showcases their dedication to safeguarding user data and rebuilding trust.

Security Enhancements:

- Multi-factor Authentication: WazirX has introduced an advanced multi-factor authentication system for all user activities. This system includes biometric verification alongside passwords, adding an extra layer of security to user accounts.

- Upgraded Cryptographic Techniques: The exchange now uses AES-256 encryption to protect transaction data. This means that the information is encrypted in real time, making it incredibly difficult for unauthorized parties to decipher.

Strategic Cybersecurity Partnerships:

- Collaborations with Top Security Firms: WazirX has partnered with leading cybersecurity firms, such as Elliptic and Merkle Science, to enhance their defensive measures. These firms help WazirX by:

- Conducting real-time threat detection.

- Performing comprehensive bi-annual stress tests and penetration tests to prepare for potential cyber threats.

Setting Industry Standards:

- Leadership in Security Protocol Development: Following the breach, WazirX has been involved in initiatives aiming to improve security standards across the cryptocurrency exchange industry. They've played a key role in:

- Forming a consortium to develop and standardize security protocols.

- Influencing the creation of new security guidelines now being reviewed by global regulators.

Through these initiatives, WazirX is not just fixing past issues but is actively contributing to a safer and more secure cryptocurrency trading environment.