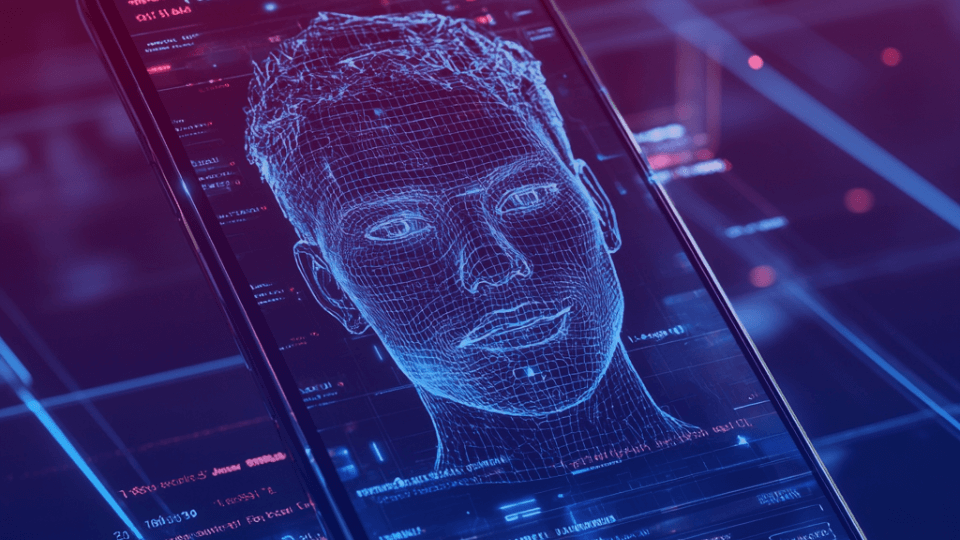

The Face of Security: How Facial Recognition is Redefining Mobile Banking Protection

Digital banking's growth is undeniable, with the mobile banking market projected to hit $7 billion by 2032, driven by a 16.8% CAGR. This trend, supported by over 200 billion expected mobile transactions by 2024, reflects a significant shift towards mobile-first financial services. Yet, this expansion brings heightened cybersecurity threats, spotlighting the critical role of facial recognition technology.

Facial recognition, leveraging AI and blockchain, has become a key cybersecurity enhancer in mobile banking. Beyond a competitive edge, it's a cybersecurity necessity, offering:

Enhanced User Authentication: Through AI, reducing identity theft risks.

- Secure Transactions: Via biometric authentication and encryption.

Banks now employ facial recognition for real-time customer service and secure transactions, significantly elevating digital banking security standards. This technology's strategic integration addresses core security concerns, fostering user trust and reinforcing mobile banking's security infrastructure.

The Technology Behind Biometric Authentication

Diving into the core of biometric authentication, facial recognition stands out for its intricate blend of geometry and photometry. This technology discerns faces through key landmarks and template matching, a testament to its sophistication. Convolutional Neural Networks (CNNs), pivotal in this domain, harness deep learning to elevate image recognition, marking a significant leap forward.

Innovations like 3D recognition and thermal imaging enhance security, ensuring accurate identification even under varied conditions. Techniques such as Skin Texture Analysis and ANFIS further refine this accuracy, merging neural networks with fuzzy logic for a sharper analysis - here’s one of our articles that decodes Facial Recognition

Yet, facial recognition's integration into mobile banking is not without hurdles. Privacy concerns and demographic disparities challenge its implementation. Nonetheless, ongoing advancements aim to mitigate these issues, evolving the technology to meet the rigorous demands of mobile banking security.

This evolution is vital. As banks like Chase demonstrate, facial recognition's application across sectors—be it law enforcement or airport security—underscores its versatility and effectiveness. By continually refining this technology, mobile banking can offer not just convenience but unparalleled security, paving the way for a future where digital banking is as secure as it is ubiquitous.

GDPR Compliance and FR

Navigating GDPR compliance, banks face the crucial task of classifying facial images as biometric data, necessitating enhanced protections. This regulation extends globally, impacting any financial institution that processes the data of EU residents, emphasizing the need for international adherence to GDPR standards.

Privacy concerns like surveillance and identity theft are at the forefront of facial recognition deployment in banking. The technology's integration calls for secure data practices and clear communication with customers on data use and protection.

For GDPR compliance, banks must:

- Ensure Lawful Processing : Via customer consent or demonstrating public interest.

- Conduct DPIAs : Essential before implementation to align with privacy regulations.

Which technology?

Selecting the right facial recognition technology for mobile banking hinges on four non-negotiables:

- Accuracy and Precision: Critical to eliminate false positives and ensure access for rightful users only. Institutions adopting VisionLabs technology report substantial fraud reduction, underlining accuracy's importance.

- Speed: Essential for a frictionless user experience. FaceMe eKYC leads with its swift, precise recognition capabilities.

- Environmental Adaptability: Must perform under various conditions. Technologies like those from IntelliVision and FaceFirst shine, adapting from ATMs to in-branch use.

- Cybersecurity Risk Mitigation: Depth liveness checks, as employed by VisionLabs, distinguish real users from representations, crucial for fraud prevention.

Integrating these technologies into existing systems poses its challenges, requiring nuanced technical and operational planning. FaceMe eKYC, for instance, demonstrates seamless integration into banking functions, from access to customer service, minimizing disruption.

Operational readiness is pivotal, ensuring customer service and fraud prevention strategies adapt without compromise. The successes of Yitu Technology and CloudWalk underscore the operational benefits of facial recognition, enhancing security and efficiency.

User experience remains paramount; integration should streamline, not complicate, banking interactions.

In essence, choosing and implementing facial recognition technology in mobile banking demands a balance of technological prowess, operational agility, and user-centric design. Drawing lessons from those who've led the way, banks can navigate the complexities of integration, ensuring security and seamless service go hand in hand.

Implementation & challenges?

Privacy laws:

Navigating the intersection of facial recognition and privacy laws, like GDPR, is crucial for mobile banking's evolution. GDPR classifies facial images as sensitive biometric data, imposing strict guidelines on their handling:

- Legal Compliance : Ensuring GDPR compliance is non-negotiable, requiring explicit consent and safeguarding user data, a practice Citibank models effectively.

- Global Standards : GDPR's reach affects not just EU-based operations but also those processing EU residents' data globally, emphasizing the need for worldwide compliance strategies.

- Risk Management : DPIAs become mandatory for high-risk data activities, guiding institutions in identifying and mitigating privacy impact risks.

- Security and Transparency : Advanced cybersecurity protocols and transparent communication about biometric data usage are essential, fostering user trust.

Citibank's adherence to these principles showcases a robust privacy framework, setting a benchmark in the banking industry for protecting personal information and complying with stringent privacy laws. This approach not only aligns with legal mandates but also enhances cybersecurity measures in mobile banking, presenting a balanced model of legal compliance and technological innovation.

User adoption

In mobile banking, user adoption of facial recognition boils down to clear communication and technology that fits into people's lives effortlessly.

- Educational Initiatives : Banks are taking the lead with campaigns that spell out the security perks of facial recognition, making sure users grasp how it shields against identity theft and unauthorized access.

- Proof Points : Real-life success stories where facial recognition stops fraud dead in its tracks do wonders for user confidence.

- Integration that Flows : It's all about weaving facial recognition into banking apps so it feels natural and enhances the banking ritual without complicating it.

- Personal Touch : Using facial recognition to personalize the banking experience can turn routine transactions into moments of delight for customers.

Banks aren't stopping there. They're crafting interfaces with user-friendliness at the heart, backed by a loop of feedback and improvements. Transparent about how they protect user data, banks are staying aligned with privacy laws like GDPR, offering peace of mind alongside innovation.

And for any bumps along the road?

Real-time support is just a tap away, smoothing out the user journey with facial recognition in mobile banking. This thoughtful approach is paving the way for technology that's not just accepted but appreciated by users, reinforcing security and trust in the digital banking landscape.

MFA and Security

Integrating facial recognition into mobile banking elevates security through multi-factor authentication (MFA), blending something the user knows, has, and is—biometrically.

This integration is revolutionizing ATM and banking experiences by enabling secure, cardless transactions and access, blending security with convenience.

Key points include:

- MFA’s Role : It’s a blend of knowledge, possession, and biometrics, significantly reducing unauthorized access risks.

- Enhanced Experience : Facilitates secure, convenient transactions at ATMs and online, making banking smoother.

- Compliance and Security : Aligns with legal standards, ensuring reliability and protection against fraud.

Addressing challenges involves:

- Fighting Fraud : Updating algorithms and incorporating liveness detection thwart spoofing and deepfakes.

- Staying Ahead : Constant updates and threat intelligence are crucial for preemptive defense.

Banks integrating facial recognition with MFA are setting benchmarks for security. Their journeys offer insights into selecting technology, educating users, and navigating adoption hurdles, demonstrating how balancing innovation with user-centric design ensures both security and usability in mobile banking.

All in all

Facial recognition technology has evolved from a competitive advantage to a critical tool in securing mobile banking ecosystems. By accurately authenticating user identities, it significantly lowers the risk of fraud and unauthorized access, addressing the dynamic cybersecurity landscape that banks face today.

For banks to leverage this technology effectively, a multi-faceted approach is necessary:

- Ongoing Vigilance : Constant monitoring for potential threats and vulnerabilities is crucial, with regular audits and risk assessments to proactively identify and address security gaps.

- Innovation Adoption : The banking sector must stay at the forefront of security technology, integrating the latest in facial recognition and other biometric methods to enhance protective measures.

- User Education : Increasing awareness about the technology’s benefits and operations is key. Banks should engage in widespread educational initiatives to foster secure practices among users.

- Regulatory Agility : With the ever-changing landscape of digital privacy and security regulations, banks need to remain adaptable, ensuring compliance with both current and forthcoming standards.

- Data Protection Strengthening : Implementing robust measures to secure biometric data against unauthorized access is paramount, employing encryption and restricting data access to authorized personnel only.

- Collaborative Standardization : By collaborating on industry-wide standards for facial recognition use, banks can collectively improve security protocols, boosting user trust in digital banking platforms.

Adhering to these strategies, banks can harness facial recognition to bolster cybersecurity defenses, providing a secure and trustworthy mobile banking experience that not only meets today's security demands but is also primed for the future.

As banks harness the transformative power of facial recognition, what stories of trust and innovation will they tell?